Description

Triple Hedging DC (Direct Correlation)- this is a multi-currency advisor, where when opening positions, the movements and conditions of three currency pairs are taken into account at the same time, which cannot be seen when testing in MT4. For testing, use the version for MT5: https://www.mql5.com/en/market/product/85880

IMPORTANT:

- Before use, make sure that in in the MT4 terminal, the currency pairs used in trade are has loaded into the window /Market Watch/ (description of currency pairs below)!

- EA to attach only to one chart (First symbol: Symbol_1), – all trading in all pairs is conducted only from one chart!

- Before using on a real account, test the adviser on a demo account (at conditions of your broker).

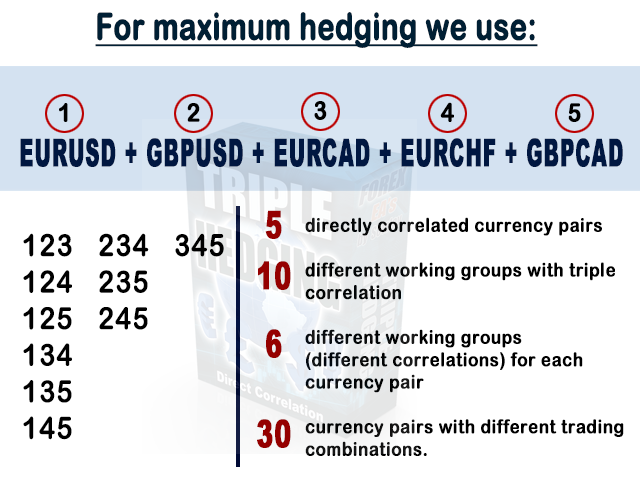

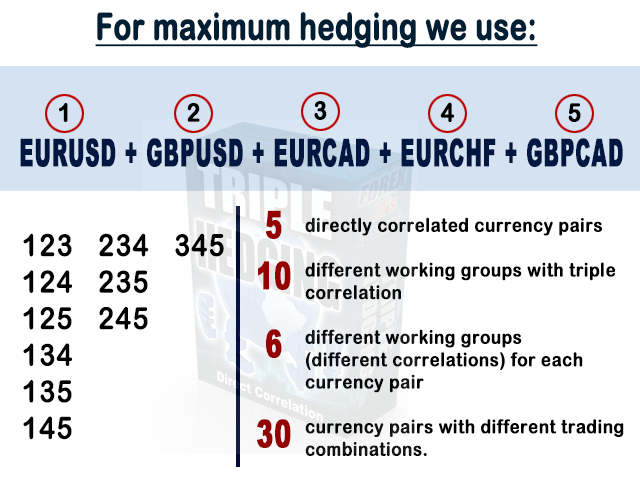

The logic of Triple Hedging DC The logic of Triple Hedging DC uses triple correlation, that is, the interaction of 3 different currency pairs at the same time, which are interconnected by direct correlation (DC – Direct Correlation). This is a truly revolutionary approach to trading, since the most important factor is excluded – this is the factor of adjusting (re-optimizing) the system to historical data, since at the same time, in real time, 3 instruments interact with each other at once and the analysis is carried out not for one currency pair separately, but is taken into account correlation movement logic (strength, direction, deviation) of 3 different instruments at the same time. For example, the defaults pairs used:

Reviews

There are no reviews yet.