Quantitative hedging strategies for the three major stock indexes of Germany, Nikkei and Hang Seng

The financial world is blooming, ups and downs, markets are changing, and participants are changing, but human nature will never change. The shining star strategy often attracts people’s enthusiasm. The dim veteran is often a bird. Five times a year is like a river crucian carp, but there are few that double in five years. This is a truth that everyone who has been in the industry for many years knows well.

“One sword in ten years, accumulate and make thin progress” has been the purpose of our quantitative team for a long time. In such a tempting world, we are well aware that the road to deep plowing in the development of trading strategies is difficult. The judgment standards and capital choices of most market participants will inevitably affect the direction of a technical team, but we are a team destined to be born for research and development! We consistently use objective criteria to evaluate each trading strategy, and use steadfast steps to advance our own development curve. We don’t use the rate of return to talk about success or failure, and we don’t talk about survival time about heroes. We talk about logic and risk. We firmly believe that if you can’t tell who or what money a strategy is making, then you must also be confused about its risk points.

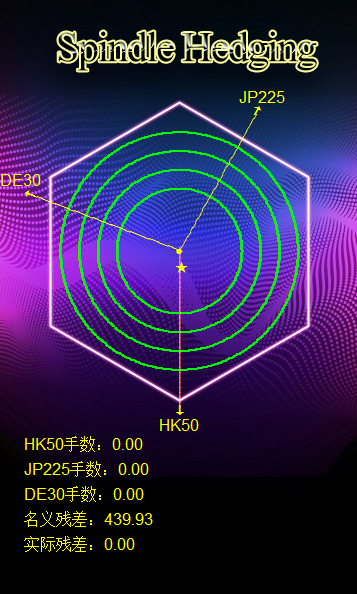

On the occasion of this two-year anniversary, our quantitative team grandly launched a quantitative hedging strategy—Spindle Hedging. We hope to share it with people who have real discerning eyes. Here is a brief introduction to this strategy.

First, let’s briefly understand the operation process of the strategy through a short video (click here ).

Strategy introduction

This strategy (Spindle Hedging) is a hedging strategy based on the three major stock indexes of Nikkei, German Index and Hang Seng Index. Click here to view the three-dimensional model of the three major stock indexes. We hope to hedge the risk of the valuation direction (the global stock index skyrocketing and falling risk as a whole) while earning profits from the differential fluctuations of the three major stock indexes. The detailed strategy principle can be clicked on this popular science post , which gives a detailed introduction to the strategy principle.

Strategy operation

Environmental choice and funding scale

| Broker | Starting capital (USD) |

| GKFX Jiekai Financial | 10000 |

| AXITRADER | 25,000 |

| other | Contact customer service for details |

The starting capital mainly depends on the size of the corresponding underlying contract of the broker. The starting capital we listed is for the consideration of a greater margin of safety.

Risk control rules

Risk: The recommended risk control line is 30%.

Note: If the customer wants the risk to be less than 30%, for the safe operation of the strategy, the starting capital needs to be increased by a corresponding multiple (for example: the customer wants the risk control line to be 15%, for the strategy to operate safely, then the starting capital of the corresponding platform needs to be increased by 30 %/15%=2 times, that is, the corresponding GKFX needs 2w USD to start; Axitrader needs 5w USD).

Expected profit

Backtest (expected) return: 30% nominal retracement rate, actual net worth retracement rate 13.75%, three-year compound return of 501%, click here to view the detailed backtest report.

Test download address

Spindle Hedging stock index hedging EA MT4 download link : SpindleHedging(MT4)

Spindle Hedging stock index hedging EA MT5 download link : SpindleHedging (MT5)