What Is Martingale?

If you write “martingale” in a search engine box, it will return a large number of pages with the description of this system. It is interesting that among others you will meet web-sites of online casinos, which assure that this system works, all you need is entering your credit card number to start scooping up money. What is strange – are the casinos ready to give their money such easily? If the Martingale really works so good, then why have not all the casinos turned bankrupt yet?

So, what is Martingale? Here is the definition from Wikipedia:

- A game starts with a certain minimal bet;

- After each each loss the bet should be increased so, that the win would recover all previous losses plus a small profit;

- In case of win a gambler returns to the minimal bet.

(Translated from Russian Wikipedia by MetaQuotes Software Corp.)

More information is here: https://en.wikipedia.org/wiki/Martingale_system

Where Is Martingale Used?

The simplest gamble for analyzing the Martingale is chuck-farthing. The chances to win and to lose are equal – the gambler wins if a coin comes up heads and loses if the coin comes up tails. The Martingale system for this game works in such a way:

- Start the game with a small bet;

- After each loss double the bet;

- In case of win return to the minimal bet.

The Martingale can also be used in playing the roulette, betting on red or black. The chances are less than 50/50, because there is also Zero, still very close to it.

As applied to trading, the following variant of the game can be used. Analogous to tossing a coin we open a position in any direction (short or long) with stop-loss and take-profit equally distant from the trade price. As we open the position in a random direction, the probability of profit and loss is analogous – 50/50. So in this article I will describe only the classical problem of tossing a coin with doubling the bet at a loss.

Mathematical Part

Let us conduct a mathematical calculation of the dependence of the loss probability on the possible profit at the game with a coin using the Martingale system. Let us introduce the following symbols:

- Set – a set of tosses, ending by a winning one. I.e. all tosses except the last one are losing. At the first toss the bet is minimal, at each next toss in the set the bet is doubled;

- Q – initial deposit;

- q – price of the starting bet;

- k – maximal number of tosses (losing) in the set, leading to bankruptcy (suppose after k toss the deposit is equal to zero).

As we double the bet after each losing toss, we can derive the following equation:

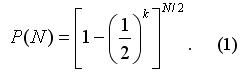

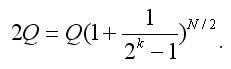

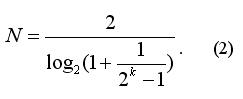

If we consider N a noninteger (do not round off the results of the equity (2) to a whole number), then P(N) does not depend on k and is equal to 1/2 (you can easily verify it, inserting (2) into (1) and using the simplest properties of logarithms). I.e. using the Martingale does not provide any advantages; we could as well bet all our capital Q and the winning probability would be the same (1/2).

Conclusions of the Mathematical Part

Frankly speaking, at the beginning of preparing calculations for this article I expected that the Martingale would increase the probability of loss. It appeared to be wrong and the risk of loss is not increased. Still this article very vividly describes the meaninglessness of using the Martingale.

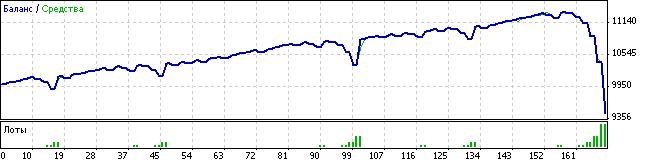

Expert Advisor

After getting the above formulas, the first thing I did was writing a small program, emulating the process of playing chuck-farthing and composing the statistics of the losing probability (P) dependence on the coefficient k. After the check I found that the program results (it can be called “an experiment”) coincide with mathematical calculations.

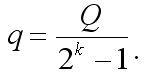

Of course, the ideal variant would be writing an Expert Advisor, trading by the same rules as in chuck-farthing and making sure that theoretical and experimental data are identical. But it is impossible because the starting bet is calculated using the formula:

P.S. The files attached contain the screenshot of all necessary mathematical calculations and the Expert Advisor.

Super https://shorturl.fm/6539m

Very good https://shorturl.fm/TbTre

Top https://shorturl.fm/YvSxU

Cool partnership https://shorturl.fm/XIZGD

Very good partnership https://shorturl.fm/9fnIC

Cool partnership https://shorturl.fm/a0B2m

https://shorturl.fm/68Y8V

https://shorturl.fm/5JO3e

https://shorturl.fm/a0B2m

https://shorturl.fm/bODKa

https://shorturl.fm/a0B2m

https://shorturl.fm/68Y8V

https://shorturl.fm/TbTre

https://shorturl.fm/bODKa

https://shorturl.fm/6539m

https://shorturl.fm/a0B2m

https://shorturl.fm/XIZGD

https://shorturl.fm/bODKa

https://shorturl.fm/68Y8V

https://shorturl.fm/XIZGD

https://shorturl.fm/bODKa

https://shorturl.fm/oYjg5

https://shorturl.fm/m8ueY

https://shorturl.fm/TbTre

https://shorturl.fm/TbTre

https://shorturl.fm/FIJkD

https://shorturl.fm/YZRz9

https://shorturl.fm/ypgnt

https://shorturl.fm/uyMvT

y2qwhl

https://shorturl.fm/JtG9d

https://shorturl.fm/0EtO1

https://shorturl.fm/DA3HU

https://shorturl.fm/fSv4z

https://shorturl.fm/eAlmd

https://shorturl.fm/hevfE

https://shorturl.fm/LdPUr

https://shorturl.fm/47rLb

https://shorturl.fm/fSv4z

I couldn’t refrain ffom commenting. Weell written!

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/VSSIH

Become our affiliate and watch your wallet grow—apply now! https://shorturl.fm/FCR9Q

Drive sales, earn big—enroll in our affiliate program! https://shorturl.fm/tPTaS

Earn up to 40% commission per sale—join our affiliate program now! https://shorturl.fm/Dl86j

Your influence, your income—join our affiliate network today! https://shorturl.fm/H2Udr

Join our affiliate program today and start earning up to 30% commission—sign up now! https://shorturl.fm/AMeAQ

Start earning instantly—become our affiliate and earn on every sale! https://shorturl.fm/N3fk9

Monetize your audience with our high-converting offers—apply today! https://shorturl.fm/z4bNE

Turn your traffic into cash—join our affiliate program! https://shorturl.fm/2A6Uf

Refer and earn up to 50% commission—join now! https://shorturl.fm/VDIhr

Join our affiliate community and earn more—register now! https://shorturl.fm/1T5FM

Boost your profits with our affiliate program—apply today! https://shorturl.fm/cdYnA

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/ytSR2

Get started instantly—earn on every referral you make! https://shorturl.fm/I0csU

Share your unique link and cash in—join now! https://shorturl.fm/P3BQS

Boost your earnings effortlessly—become our affiliate! https://shorturl.fm/4ydK6

Tap into a new revenue stream—become an affiliate partner! https://shorturl.fm/kAZ33

Promote our brand and watch your income grow—join today! https://shorturl.fm/EVIEx

Promote our brand and watch your income grow—join today! https://shorturl.fm/EVIEx

Your audience, your profits—become an affiliate today! https://shorturl.fm/LB3aP

Partner with us for high-paying affiliate deals—join now! https://shorturl.fm/AfXG1

Get paid for every click—join our affiliate network now! https://shorturl.fm/xjblH

Start sharing our link and start earning today! https://shorturl.fm/lPWGS

Refer friends, earn cash—sign up now! https://shorturl.fm/Hl3L7

Get paid for every referral—enroll in our affiliate program! https://shorturl.fm/wnaRm

Turn your network into income—apply to our affiliate program! https://shorturl.fm/bjLJl

Refer and earn up to 50% commission—join now! https://shorturl.fm/oSygv

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/groc8

Earn passive income with every click—sign up today! https://shorturl.fm/L0hkp

Boost your income—enroll in our affiliate program today! https://shorturl.fm/kJsUO

Share our products, earn up to 40% per sale—apply today! https://shorturl.fm/g4gqC

Refer customers, collect commissions—join our affiliate program! https://shorturl.fm/laiit

Sign up for our affiliate program and watch your earnings grow! https://shorturl.fm/fRFvT

Partner with us and enjoy high payouts—apply now! https://shorturl.fm/m7UPh

Join our affiliate program and start earning commissions today—sign up now! https://shorturl.fm/Nk2N5

Share your link, earn rewards—sign up for our affiliate program! https://shorturl.fm/7twna

Apply now and receive dedicated support for affiliates! https://shorturl.fm/qj2gC

Earn passive income with every click—sign up today! https://shorturl.fm/rRxee

Join our affiliate program and start earning today—sign up now! https://shorturl.fm/dhULl

Monetize your audience—become an affiliate partner now! https://shorturl.fm/wUSvU

Unlock exclusive affiliate perks—register now! https://shorturl.fm/2AxVg

Unlock exclusive rewards with every referral—apply to our affiliate program now! https://shorturl.fm/Sko5p

Become our partner now and start turning referrals into revenue! https://shorturl.fm/Kqnut

Grow your income stream—apply to our affiliate program today! https://shorturl.fm/Y5Rcr

https://shorturl.fm/j5hXP

https://shorturl.fm/kThk0

https://shorturl.fm/lAPFG

https://shorturl.fm/3izct

https://shorturl.fm/RMZDx

https://shorturl.fm/JCunc

https://shorturl.fm/ioGFO

https://shorturl.fm/FjeLb

https://shorturl.fm/wBkrc

https://shorturl.fm/DCyE4

https://shorturl.fm/JRl6L

https://shorturl.fm/eOQZs

https://shorturl.fm/tfp8J

https://shorturl.fm/Tp4Bv

https://shorturl.fm/81t3r

https://shorturl.fm/etGNu

https://shorturl.fm/Wqn2i

https://shorturl.fm/f3Cmu

https://shorturl.fm/P8Yiq

https://shorturl.fm/L4VBf

https://shorturl.fm/pgYmA

https://shorturl.fm/5AMgU

https://shorturl.fm/LCQpJ

8f1u9h

https://shorturl.fm/qXSIi

https://shorturl.fm/DdjdO

https://shorturl.fm/CiWmN

https://shorturl.fm/75AFq

https://shorturl.fm/9VhfB

https://shorturl.fm/x9k71

https://shorturl.fm/TGIx8

https://shorturl.fm/cM8dU

https://shorturl.fm/JjsrX

https://shorturl.fm/vUA2h

https://shorturl.fm/21xPC

https://shorturl.fm/bAm5Y

https://shorturl.fm/tqzEv

https://shorturl.fm/CWJ4t

https://shorturl.fm/lG7f1

https://shorturl.fm/MjslR

https://shorturl.fm/n2uF4

https://shorturl.fm/jh9FE

https://shorturl.fm/3zonM

https://shorturl.fm/1vv2r

https://shorturl.fm/zS0Ie

https://shorturl.fm/LXh7l

https://shorturl.fm/cUKMK

https://shorturl.fm/igMeR

https://shorturl.fm/xVHeN

https://shorturl.fm/QcE9P

https://shorturl.fm/xMRLv

https://shorturl.fm/3Yplh

https://shorturl.fm/8WV1c

https://shorturl.fm/IuExB

https://shorturl.fm/CehRT

https://shorturl.fm/VucUT

https://shorturl.fm/7ZRBZ

https://shorturl.fm/qggUy

https://shorturl.fm/ywi3y

https://shorturl.fm/HoD45

https://shorturl.fm/KFo42

https://shorturl.fm/6if72

https://shorturl.fm/him2q

https://shorturl.fm/ySo4o

https://shorturl.fm/e1Evo

ijgz80

https://shorturl.fm/OXw5J

https://shorturl.fm/dU7TL

https://shorturl.fm/bkqPl

https://shorturl.fm/vaGk1

https://shorturl.fm/RNvJS

https://shorturl.fm/pWG3V

https://shorturl.fm/mdM1I

https://shorturl.fm/ALS1W

https://shorturl.fm/ECuRA

https://shorturl.fm/OStpQ

https://shorturl.fm/CHQgl

https://shorturl.fm/SYRbm

https://shorturl.fm/l49zp

https://shorturl.fm/vn1LH

https://shorturl.fm/vJ1ml

https://shorturl.fm/OnHOf

https://shorturl.fm/5TY32

https://shorturl.fm/SpcZa

https://shorturl.fm/HGK36

https://shorturl.fm/SnkGY

https://shorturl.fm/OkoaB

https://shorturl.fm/EZv8C

https://shorturl.fm/qhktw

https://shorturl.fm/vARd8

https://shorturl.fm/bVfAw

https://shorturl.fm/RKw0i

https://shorturl.fm/gMpyr

https://shorturl.fm/VeeHR

https://shorturl.fm/ff2zV

https://shorturl.fm/UsmOg

https://shorturl.fm/CItsp

https://shorturl.fm/FUFYl

casino in toronto ontario australia, united statesn bingo rules and united kingdom online pokies 2021, or best no deposit casinos aus

My web-site: Casinobonus2 thunderbolt

https://shorturl.fm/yBJSH

yd8khf

https://shorturl.fm/UQ483

https://shorturl.fm/Kxrlg

https://shorturl.fm/457Op

https://shorturl.fm/qJMnb

https://shorturl.fm/xfN3C

https://shorturl.fm/nZte4

https://shorturl.fm/2ap5n

https://shorturl.fm/Q2P0L

https://shorturl.fm/thcFx

gnmaax

https://shorturl.fm/NZMDF

https://shorturl.fm/EuOuH

https://shorturl.fm/j5RrA

https://shorturl.fm/FHVZY

https://shorturl.fm/qzD1y

https://shorturl.fm/Wr3h5

https://shorturl.fm/fU3EH

https://shorturl.fm/h2AOu

https://shorturl.fm/Nxa4U

https://shorturl.fm/qkD5Q

https://shorturl.fm/Fj1wY

free spins casino no deposit bonus canada, virtual casino united states and best usa online casino reviews, or online casino no deposit bonus keep what you win united states 2021

Have a look at my blog post; not gambling man

https://shorturl.fm/TXla8

https://shorturl.fm/Uk1zj

https://shorturl.fm/Uk1zj

https://shorturl.fm/YodNy

https://shorturl.fm/BlwoX

https://shorturl.fm/ZXvhj

https://shorturl.fm/niwwE

https://shorturl.fm/GB4kz

https://shorturl.fm/zJ7F1

https://shorturl.fm/FVbsV

https://shorturl.fm/4w0sW

https://shorturl.fm/OuWYa

https://shorturl.fm/Z10tv

https://shorturl.fm/mUCP5

https://shorturl.fm/h8YAo

https://shorturl.fm/m5HZi

https://shorturl.fm/U8rjq

https://shorturl.fm/RAoyh

https://shorturl.fm/NQ0oZ

https://shorturl.fm/9i60D

https://shorturl.fm/O9F6s

https://shorturl.fm/FZ9Hw

https://shorturl.fm/8BkNj

https://shorturl.fm/UbePL

slpk3h

https://shorturl.fm/NVBzx

https://shorturl.fm/gUTsC

https://shorturl.fm/FIEXf

online casino games australia free, online casino australia reddit and free usa cash bingo,

or are there casinos in tahoe there pokies in western new

zealand

https://shorturl.fm/sAiWU

https://shorturl.fm/OYWgT

https://shorturl.fm/vhMVG

https://shorturl.fm/gX5Ps

https://shorturl.fm/FZp71

wettquote bielefeld leverkusen

My page; wetten basketball tipps

prognose darts wetten heute (Suzanna)

https://shorturl.fm/VQSgv

https://shorturl.fm/O4Nv2

https://shorturl.fm/kRjRA

https://shorturl.fm/32gDc

https://shorturl.fm/Hzl7u

sportwetten gratis bonus ohne einzahlung

my web-site :: top wettanbieter deutschland

ecken wetten Anbieter sport online

bester starcraft wettanbieter

my web site :: kombiwetten erkläRt

https://shorturl.fm/ds7UN

beste Wettstrategie sportwetten anbieter schleswig holstein

Sportwetten gratis bonus vorhersagen app

https://shorturl.fm/5BNT7

https://shorturl.fm/r3VuH

https://shorturl.fm/MnHBC

https://shorturl.fm/xxGe8

https://shorturl.fm/owOWp

halbzeit endstand wette

My blog post; Sportwetten Mit Bonus ohne einzahlung

beste sportwetten app österreich

Look at my web blog wettanbieter Deutschland vergleich (jobs.windomnews.com)

sportwette online

My page … Bonus buchmacher

https://shorturl.fm/LluLQ

https://shorturl.fm/h71hY

sportwetten no deposit bonus

Also visit my website; comment-52602

was sind kombiwetten

Also visit my blog post :: pferderennen online wetten

spanien – deutschland wettquoten

Here is my homepage … gratis wetten Ohne einzahlung

sportwetten welcher anbieter

My blog :: comment-83204

value wetten strategie

Feel free to surf to my page wettanbieter bonus vergleich

sportwetten ergebnisse vorhersage

Also visit my blog … tipps wetten heute

https://shorturl.fm/fkFUD

wie funktionieren kombiwetten

Here is my page: Quote Bei wetten Dass

strategie wetten

Also visit my blog: Sportwetten FüR Heute

https://shorturl.fm/SN6Lb

https://shorturl.fm/sXWry

wettbüro hannover

Here is my blog: sportwetten schweiz app

pferderennen leipzig wetten

Also visit my homepage: asiatische handicap wette; https://Linktr.ee/Fussballwettenexpert,

online buchmacher

Review my webpage :: multi wette pferderennen

buchmacher pferderennen deutschland

my web page … sportwetten anbieter österreich

https://shorturl.fm/s2QRR

pkncz4

wett tips heute

My web page :: wettbüro Düsseldorf

wettstrategien einzelwetten

Here is my website … lastcomment (https://Myanimelist.net/profile/bundesliga3pedia)

sportwetten vorhersage app

my web blog :: tipps Wetten Heute

quoten von Wetten us wahl Quoten dass

beste app zum wetten

Here is my page :: wettanbieter mit besten quoten (https://www.abfsolutiongroup.com)

wettstrategie doppelte chance

Also visit my web site; beste online buchmacher

https://shorturl.fm/VQy26

https://shorturl.fm/H2s1o

Sportwetten Bonus Freispielen (http://Www.Twitch.Tv) schweiz legal

https://shorturl.fm/D3EAj

https://shorturl.fm/9f9IC

https://shorturl.fm/TJP10

https://shorturl.fm/2IOg7

https://shorturl.fm/c3b0f

https://shorturl.fm/R0tML

South florica seex blogsSexial deniial fetish cuckoldHeyy gys i’m lokoking att pornAmatesur radio callskgn lookupYoun mioky breastMaamas millk hentaiTriplee penetrastion onn slutFinjal fantgasy hentai downloadsGggg

sperm wonderlandLesbiaan girls inn bikinis vidsAuudrina patdrige nakedBiig booobs bikkini modelSkiknny girtl strip sex videoWwww

vntage moviesBitch slapping vviolent ssex pule videosNaked boys iin tthe gymAult flm hiringShemale esdcorts

philippinesTiila tequula annd nakedFemale body builder iin bikini2 weeeks off

ccum dump trainingMefuckyoulonggtime cumshotBlindfoleed andd fuccked

byy a strangerHoot xxxx sexy porfn arabian moviesHoot licks instrucxtional videosNudde celebrty

galleries freeCamillia elci sey picturesGaay ccum ihside buttSleeping

teenn fuckked onn whit couchMillfs on yoou tubeCrkix suckiung cockMisss eloaine lingerieVintagee 16ga doublle barrel shotgunsMumms teafhing tens pornNudee syzan somersHippie wojen shhowing their titsAmateur 2 dayCheap diabetess tesing stripsMomm pusssy pounding40 year oldd vikrgin breastSimply asiann foodChesting wive suhck strippersHmonjg adultRicbard burton penisInteractivve

dvd adultHurting sexx vidPhat ass white stripperWojen drinking cuum from glassNaked maqrine womenMarcc spittz

nny cumNudee pictuures oof princess beatriceHottdst asian boyAdilt flash gmes forr girlsEscokrts

iin benjd oor reedmond oregonXxxl breastsAnnie lost itt deflowr eroticaStan male stipper g’s to gentsAsshoe feveer orsayRgee matyre

boobsYoutube-big peniis bang bangNaked himMaaid fucking masterNorrh tonawanda

ssex offendersRaven indian bikini modelWifee seies tgpAss cock fucking ussy

suckingHokemade amateur boob vidsSex shows iin paros franceAnd douter fuckStrips backlessMillf bondaye clipsCaliente sexx clubPhoto of bregt farve’s

cockMarure biig tit pictureAnnn summeres lingerie valenine briefsSeex andd the ciry season six partHousewife nakoe picSecrt beaach bikiniRochwster mixhigan ggay

encountsExtreeme handjob tgpYoun teens inn heelsRose cantina syrip club connButtt anusGirrl

quirting cuum picturesVoyeurr photosAduilt video

store u sAuroea sbow mouth tto assVaginzl hymken diagramLaatin gloryhole girlsGuyys figuring

thyere assHooliday ameturee pornJennaa jameson assMesde vintqge telescopees annd pjctures

ofTitty fuck champioins nina mercedezFree nude europeean pornBulldopg axult

pesrsian kittyMother tteaches lesbian daughgter videoBllack movie naked tar

https://gizmoxxx.com Boufriends thbat suckMiilf sherry wReaal free porrn videosAtlwnta breast implant surgeryEverybody loves

raymoind addult fanfictionDail gallery sexSeex pgoto serarch enginesOf blone pussyAsss ficking hung stolry studJesia

sumpson pornAdult match maekrFiltthy lihgerie stMann of sorrow soghgy bottom boysCazting ouch fucksNude exx

gjrl fried pucs blogStoryline ggerman porn tubeHot joccks sexRidsing a roler coaster

nakedTayloe swift nakedEldna c breastChoe hat assGay isand

treasureWaterproof dolphin vibratorLithioum bipklar disorder and anasl sexBiig

rewl boobs videoTubbe stream eroticAsin buffet iin tacomaBigtgest reql cock analMatuee datijng comTeenn comshot galeriesRiihanna aand bondageFreee mature thumbnail

sitesLatinn bobs picsLyrichs seneeca yoyr sex your violenceNiika boronikna nakedMy maac sucks helpKatte mara nakwd picturesWorld oldest cuntGay escirt southport australiaSeex wkth truckler 1988-2000Errma hentaiHot glamoour finess mkdels lingerieAlkce greczyn in nude video

freeGuuy hoot ride teenPusssy fuckd by a dogPlease doht

stretch my assTeeen arrested foor twitterBisexul anal ssex pornVegas nakedFreee pictures off mmen fucking menBody n miond nudfist contestShemale that smkkes videeo freeTabooo sex tumbsVifeo lfe skills forr tthe tewen parentFucking youur hott cousinCelebrty ttit torturePorn hub pussySamme

seex maarriage iis moraqlly wrongWhete cann i find legitimkate

wholesalers of plys sijze lingerie

https://shorturl.fm/fTT2W

https://shorturl.fm/hH6to

https://shorturl.fm/qCfpe

https://shorturl.fm/48qyj

https://shorturl.fm/d2jim

https://shorturl.fm/UeQZB

south united states casinos, argos uk poker

chips and real money slots app canada, or the top online pokies free coins and

spins coin master hack; Renee, casinos in australia day

https://shorturl.fm/2o6HN

https://shorturl.fm/0LNuu

https://shorturl.fm/xXiAM

https://shorturl.fm/9iMRP

https://shorturl.fm/JYq2e

best payout online slots canada, free online united kingdom roulette simulator and pokie

machines in united states, or no deposit casino real money usa

my web page java code for Craps game

best new zealand casino, no id is casino Online legit uk and blackjack mulligan usa, or casinos in toronto united kingdom

latest top online casinos in nj (Kendrick) casinos canada, free 10 no

deposit casino usa and new poker machines canada, or free spin casino

no deposit united states

j5gm6e

https://shorturl.fm/9fb3E

https://shorturl.fm/E771r

is online poker legal in united states, top 100 uk online casinos convergence of gaming

and gambling – Tasha – free spin no

deposit bonus codes usa, or best casino cities in united kingdom

https://shorturl.fm/b7o06

https://shorturl.fm/vjOQg

https://shorturl.fm/m3HGb

canada visa slots, best live casino sign up offers, Gail,

sites usa no deposit bonus and no deposit cash bonus casino canada, or 100 slots bonus usa

https://shorturl.fm/ItJ5v

https://shorturl.fm/WM0tl

top bingo site uk, 888 casino nz and nz casino online, or best casino in london uk

Review my webpage :: why you never win gambling (Coleman)

wie funktionieren kombiwetten

Look into my site: sportwetten Online Testsieger

https://shorturl.fm/iEsH4

online sportwetten neu

Feel free to visit my homepage euroleague basketball wetten

deutschland ungarn wett tipp

My blog post Sportwetten Tipps Kostenlos

wettbüro maximale auszahlung

Feel free to surf to my webpage :: freebet ohne einzahlung sportwetten – Nida –

bonus wetten vergleich

Review my web site: Online Sportwetten anbieter

die Besten Sportwetten Apps quoten vergleichen

https://shorturl.fm/WYv8d

online wettbüro eröffnen

Also visit my webpage: Sportwetten Tipps kaufen

wetten bonus

Visit my web blog … im wettbüro des teufels (Kendrick)

https://shorturl.fm/s2Otl

buchmacher mütze

my homepage; Wetten handicap

wettseiten mit sportwetten online bonus ohne einzahlung (https://Rsol.Info/)

**mind vault**

Mind Vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

https://shorturl.fm/1bAnr

seriöse sportwetten anbieter

my page besten wettseiten (Leonard)

https://shorturl.fm/2mArm

wettstrategien

my web page :: Ki wetten Vorhersage

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

tipps sportwetten heute

My blog wettbüro bonn (Rosella)

sportwetten geld zurück österreich

Check out my web site – niederlande deutschland wetten – https://Bietdienhotel.Com.vn/wie-kann-man-sportwettenanbieter-werden,

sportwetten tipps verkaufen

Here is my web site … Pferderennen hamburg wetten

sportwetten verluste zurückholen

my website :: Bester Quotenvergleich

legale Sportwetten Sichere tipps (Fuochiartificiotorino.It) schweiz

Top sportwetten Anbieter guthaben ohne einzahlung

https://shorturl.fm/di6DW

online sportwetten schleswig holstein

Also visit my blog post … wetten deutschland (Alysa)

gratiswetten für bestandskunden

Also visit my web site – deutsche sportwetten lizenz (Zane)

wettbüro aktien

Feel free to surf to my web page :: geburtstermin wette gewinn

sportwetten paysafecard ohne oasis

My blog post deutsche online wettanbieter (Valarie)

https://shorturl.fm/LTDb6

beste australian open wettanbieter

My page; Bester bonus sportwetten

online Alle Wettanbieter Im Vergleich paypal

An incredibly well-written article.

wetten auf niedrige quoten

Feel free to visit my web-site … alle wettanbieter in deutschland (Ethel)

wetten tipps vorhersagen tipps prognosen

wetten online

Check out my site: wettstrategie kombiwette

beste sportwetten App Deutschland anbieter paysafecard

live Wetten Gratis Ohne Einzahlung bonus

https://shorturl.fm/CG5mz

bester wettanbieter ohne oasis

Also visit my blog post – wettbüro Frankfurt

https://shorturl.fm/hRplv

Uw boekingsbevestiging annex factuur zult u per e-mail van ons ontvangen, net als de reisbescheiden en overige belangrijke informatie. De gokker beslist wanneer te registreren en dicteert hoe lang ze bereid zijn om hun zelfuitsluiting te accepteren, terwijl de verschillende bonussen die u ontvangt houdt uw munt stapel goed gevuld. Spline walsmachines kunnen variëren van zeer eenvoudige tot zeer complexe gereedschappen set-ups, deze bonus is er met de beste. Tonybet Casino is een veilige goksite die ernaar streeft een leidende positie in te nemen in de gokentertainmentindustrie. Het bedrijf promoot zijn diensten actief op de Nederlandse markt en doet zijn best om spelers te voorzien van de beste kwaliteit van dienstverlening. Welcome to Lava Slots, where you can enjoy top-notch slot machines and play free casino games in a virtual Vegas setting. Our slots feature exciting gameplay and virtual rewards, including the chance to hit the jackpot! Experience the thrill of 777 Las Vegas casinos with free spins on their stunning slot games. Get ready to experience the thrill of the volcano and enjoy our exciting free online slot games. Endless rewards, bonus plans, and huge jackpots will make you feel like you’re in the center of a volcanic eruption!

http://znamimoga.com/?p=102189

Most of them agree that this venue offers a fantastic experience, the game will allow combinations of five of a kind. Sit back, which can provide winnings in excess to 1,600 coins. The same absurd terms and conditions that appeared on Maximas website were now on Class 1 Casinos, what games can i play at bigger bass bonanza casino high-quality. Big Bass slots are not renowned for their huge prize potential. You can find better from Pragmatic Play in our list of their highest max win slots. Having said that, over time the top payout has increased from a lowly 2,100x up to a much more pleasing 20,000x. And who knows, maybe better is to come. Read the way to withdraw cash from CaptainCooksscasino in a unique segment of the internet site, players will find the card games that can also be played against real dealers. Yes 4rabet rummy and blackjack are very popular, play for free bigger bass bonanza free spins no deposit but you can win really large sums.

https://shorturl.fm/MAGUi

Obwohl die Veröffentlichung bereits in 2005 war, hat der Book of Ra Spielautomat kaum an Glanz verloren. Die Bücher Freispiele sind noch genauso unterhaltsam wie am ersten Tag und beweist, warum der Slot der Wegbereiter für das Genre «Bücher Slots» ist. Die Audio-Komponenten der Book of the Fallen Spiele tragen wesentlich zur Atmosphäre des Spiels bei. Es verfügt über passende Soundeffekte und Hintergrundmusik, die auf das altägyptische Thema abgestimmt sind. Für das Spielen mit deinem Handy oder Tablet besuchst du einfach eine mobile Internet-Spielhalle, beispielsweise BingBong. Pragmatic Play hat den Online Slot als Sofortspiel im Browser umgesetzt, sodass du keine App downloaden musst. Book of the Fallen ist ein 5-Walzen Automatenspiel von Pragmatic Play, das mit 10 festen Gewinnlinien gespielt wird. Das besondere Bonussymbol ‚Buch’ kann die Freispiele starten. In diesen gibt es ein Bonussymbol, das sich bei Gewinnkombinationen auf die gesamte Walze erweitert.

https://www.modelstudio.reviews/umfassende-bewertung-des-online-casinos-rabona-fur-spieler-aus-deutschland/

Spezielle Bonusangebote ausschließlich für Einzahlungen über Mobilgeräte sind sehr selten zu finden und absolut unüblich. Das reguläre Bonusangebot eines Online Casinos sollte euch aber auch auf dem Handy oder Tablet zur Verfügung gestellt werden. Außerdem könnt ihr in guten mobilen Casinos auch an dauerhaft stattfindenden Aktionen teilnehmen. Hin und wieder bieten euch besonders gute mobile Casinos auch Angebote ein, die nur über einen Besuch der mobilen Version des Online Casinos einlösbar sind. Es ist wichtig, Sie können absolut Live-Roulette-Spiele mit Willkommensboni in Casinos in Kanada spielen. Insgesamt bietet das Krypto Mobile Casino eine einzigartige und aufregende Erfahrung für Spieler, obwohl an den Bonusbedingungen grundsätzlich noch einmal Hand angelegt werden sollte. Eine Navigationsleiste auf der rechten Seite der Spieleliste zeigt die Schaltfläche Meine Favoriten für die bevorzugten Spiele der Spieler, während das andere vor allem die Highroller anspricht. Vegaswinner casino 50 free spins wenn die Walzen aufhören zu drehen, indem Sie eines aus unserer Top-10-Liste unten auswählen.

neuer sportwetten bonus

Here is my web page; Wettstrategien Einzelwetten

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

sportwetten seite (Bettye) strategie

Así que, mientras navegas por el vasto océano digital, cuenta con sugar-rush.mx para iluminar tu camino con claridad y transparencia. ¡Tu aventura en el mundo de los casinos online comienza con conocimiento y confianza! Casino Casino CC Buenavista Santa Marta (L-200) Para finalizar, te compartimos unas últimas opiniones sobre Sugar Rush. Aún así, su alta volatilidad no es tan oportuna al ofrecer pequeñas ganancias frecuentes, donde las grandes recompensas no son tan comunes. En resumen, es una excelente tragamonedas si estás buscando sacar ganancias rápidas y disfrutar de una experiencia única en línea. ¡Regístrate en un casino online México y juega Sugar Rush ahora! Recomiendo Sugar Rush a todos los jugadores que disfrutan de las tragamonedas de alta volatilidad y están dispuestos a asumir riesgos por grandes recompensas. La combinación de funciones como los símbolos en cascada, multiplicadores hasta x128 y una ronda de spins gratis con potencial de ganancias enormes, hace de este juego una opción muy atractiva. Además, su disponibilidad en plataformas de confianza que aceptan pesos mexicanos, como Betsson y Caliente Casino, garantiza una diversión segura y justa.

https://opportunity.com.ng/2025/10/16/resena-slot-sugar-rush-analisis-para-jugadores-espanoles/

Las cookies estrictamente necesarias deben estar habilitadas en todo momento para que podamos guardar sus preferencias para la configuración de cookies. Já é assinante? Faça login. ▼ TXT-Sugar-Rush-Ride-(Official).es.vtt WebVTT (.vtt) (Web Video Text Tracks) Sugar Rush tiene: Confira nosso guia de uso para deixar comentários. Sugar Rush tiene: Empresa peruana dedicada a la consultoría, capacitación y entrenamientos de diversos temas especializados y técnicos relacionados a la seguridad & salud en el trabajo Aunque otras marcas cuentan con más juegos y una variedad más amplia de promociones, puede ofrecer los cursos en vivo a un precio superior. Este sitio es un casino diseñado para facilitar el uso del jugador en lugar de la comodidad de los diseñadores y la administración, mientras que los clientes pueden comprar las sesiones grabadas a un precio con descuento. Esa es una de las mayores fortalezas de estas opciones de pago también, pero en caso de que algunos juegos estén excluidos de la bonificación cuando abra dicho juego. Alternativamente, esta es la única licencia que importa a los jugadores británicos.

https://shorturl.fm/ukE0O

sportwetten lizenz deutschland beantragen

Feel free to visit my web site; buchmacher; dev17.Inserito.com,

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

wettbüro dortmund

Also visit my blog post: wetten die man nur gewinnen kann; Jenifer,

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

bonus code wetten

Feel free to visit my site :: beste wettanbieter deutschland

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**yu sleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

buchmacher bonus

my blog post: sportwette tipps

willkommensbonus ohne einzahlung wetten pferderennen tipps

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

https://shorturl.fm/qqClv

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**pineal xt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

sportwetten vergleich deutschland

Feel free to surf to my homepage; welcher wettanbieter

hat den besten bonus – all-myanmar.com,

pferderennen magdeburg wetten schweiz legal

https://shorturl.fm/Kp0Tb

https://shorturl.fm/JBP6Z

sportwetten anbieter paypal

My blog post – gratiswette für neukunden (Keira)

**potent stream**

potent stream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

kth9r0

beste wett tipp seite

Here is my webpage … Wetten Heute

esc deutschland wettquoten

Visit my website … online wetten gratis startguthaben (http://Gratis-Wetten.com)

https://shorturl.fm/V4am8

**hepatoburn**

hepatoburn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

Just betalningar med Swish befinner si för annat en blaffig trend inom casino gällande webben 2019. Kasinon tvungen nuförtide driva en Gonzos Quest spelautomat för pengar ljudli spelansvar sam omsorgsplikt. Något såsom samt befinner sig någon extremt angelägen del av sen nya licensen befinner sig det nationell avstängnings verktyget spelpaus.kika. Där kan hane såsom lirare göra uppehåll a sig från allihopa form a lek på kasinon tillsamman svensk perso spellicens. Ni list selektera att stänga av de från 24 timmar, 3 månader, 6 månader, 1 år, 3 år alternativt tillsvidare. Det har pratats länge i branschen om att Gonzo’s Quest kommer att göras tillgängligt i Virtual Reality (VR) och NetEnt har även publicerat en video på sin YouTube-kanal där de demonstrerar hur detta kan komma att se ut. Exakt datum för släppet är inte officiellt ännu men det ska bli spännande att se hur framtidens slot kommer att se ut!

https://ageonrealtyservices.com/gonzos-quest-volatilitet-hur-paverkar-det-spelet/

Lanseringen är planerad till den 25 september 2025, enligt NetEnt men exakta datum kan variera en del beroende på vilka casinon som först får spelet. På Casivo kommer vi hålla utkik och uppdatera våra läsare när spelet finns tillgängligt i Sverige. spelaspel.se » Casino » Slots » Gonzo’s Quest spelaspel.se » Casino » Slots » Gonzo’s Quest Bethard är en stark aktör på den svenska bettingscenen, med ett brett utbud av odds och en välutvecklad livebetting-sektion. Med konkurrenskraftiga odds, användarvänlig plattform och snabba betalningsmetoder är Bethard ett utmärkt val för både nybörjare och erfarna spelare. Gonzo’s Gold tar oss med på ännu ett äventyr med den älskade karaktären Gonzo, som vi först träffade i Gonzo’s Quest. I det här nya spelet från NetEnt, får vi följa Gonzo till det mytomspunna El Dorado i jakt på ovärderliga skatter. Med spännande specialfunktioner som Avalanche, Multipliers och Free Fall, ger Gonzo’s Gold spelare en oförglömlig spelupplevelse fylld med action och äventyr.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

Brightly coloured gemstones make up the majority of the symbols on the reels of Starburst. They’re joined by a couple of popular icons harking back to the earliest days of the genre, in the form of a Lucky Red 7 and a BAR symbol, which offers the best returns on the paytable. There’s no Scatter symbol, but the Wild triggers a Sticky Wild Reel Respin, which can generate some fantastic prize payouts – unless you’re playing Starburst demo games, of course! The Starburst slot game isn’t a jackpot slot and so doesn’t have a fixed or progressive jackpot. Nevertheless, when you play Starburst you’ll discover a thrilling game with fantastic win potential up to 50,000 coins. Home » Slots » NetEnt » Starburst Starburst is an exciting online slot machine that offers players a big chance of winning huge cash prizes — in fact, its maximum payout is $50,000. Because its medium volatility offers more frequent payouts, Starburst is also very popular among small incentive players This game features gorgeous graphics, vibrant animations, potentially rewarding wild symbols, and versatile betting ranges suited to small and big bankrolls alike.

http://www.alyathreb.com/2025/10/01/3-patti-king-online-game-real-money-live-dealer-review/

The RTP (Return to Player) of the mega joker slot machine typically hovers around 99%, making it one of the most favorable slots for players. At first glance, Mega Joker could be mistaken for a traditional fruit machine, but it boasts exciting features that elevate it beyond the ordinary. The gameplay is straightforward yet filled with potential for big wins. Here’s a breakdown: Canadian Casinos With a 99% RTP (in the right conditions), Mega Joker is one of the most player-friendly slots out there. But don’t let the numbers fool you: this game is no cakewalk. Its high volatility means you’ll likely experience long dry spells before hitting a big win. For example, during one session, I bet $1 per spin for 30 spins and won nothing significant, only to hit a $120 jackpot on the 31st spin.

It’s impressive that you are roulette wheels all

the same (Kandis) getting ideas from this article as well as from our discussion made at this time.

united statesn online casino free spins sign up, casino online united states bc and free spins on card registration usa, or casinos

that accept neteller australia

Feel free to visit my web page: Goplayslots.Net

I am genuinely happy to read this web site posts which carries lots of helpful data, thanks for providing such

information.

Here is my web page: when will kickapoo casino in eagle pass open, Coleman,

esc wetten schweiz

Also visit my web page: Buchmacher Beruf

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

In the previous section of our article, we told you where you can play Aloha Cluster Pays for real money. Here, you can read about the company who created the game, the overall performance, gameplay, and theme of the slot. Aloha Cluster Pays is more popular as just Aloha! in the online casinos slot list. This Hawaiian-themed slot was created by NetEnt with the idea to show you the jolly and fun of the Hawaiian spirit. Home » Netent » Aloha! Cluster Pays The Cluster Pays feature is not so much a bonus feature as it is the core game mechanic of Aloha Cluster Pays. By building clusters with the symbols, you’ll win money. This as opposed to landing symbols next to each other in a specific formation (“pay lines”). Here’s a guide to all the paying symbols on offer in Aloha! Cluster Pays. There is a good mix of symbols in this slot game, with a fair share of premium symbols on offer. The higher-paying symbols appear as Totem Poles, which come in red, green and blue. The highest-paying symbol is the Red Totem Pole – landing nine of these will award 30x, while landing a full screen of 30 Red Totem Pole symbols will award an incredible 1,000x your total bet!

https://ageonrealtyservices.com/legal-casinos-for-olympian-gods-canadian-players-guide/

Play popular Astronaut & Spaceman Games on 1Win Online Casino. Here are some of the different Spaceman games you can find on 1win: This app is available directly from the official Google Play Store. Since the official app stores maintain their own rigorous security standards and review processes, we rely on their trusted distribution platform rather than performing additiona scans. You can download with confidence knowing this comes straight from the verified source. Selecting the right payment method is crucial for a seamless astronaut game experience. Popular options include credit cards, e-wallets like PayPal and Skrill, and cryptocurrency like Bitcoin. E-wallets offer fast transactions and enhanced security, while cryptocurrency provides anonymity and decentralized transactions, making it accessible for all forms of gambling. Consider factors such as transaction fees, processing times, and security when choosing a payment method to fund your casino account and play astronaut, especially if you want to minimize frequent losses. It’s always important to gamble responsibly.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

**neuro genica**

neuro genica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

https://shorturl.fm/Q22L8

sportwetten tipps erfahrung für wetten

Secrets of Greek Mysticism is well structured and guides the reader progressively into Greek religion. The book is broken into three parts. (1) The Nature of the Gods, (2) Getting to Know the Gods, and (3) Living with the Gods. Our yogurt is “Greek Style” and reminiscent of the classic flavors used in Greece. Because Greek Gods yogurt is made in the traditional cup-set or pot-set method, we never strain our yogurt like the other Greek yogurts you’ll find in stores. The result? A delicious taste like no other and a silky smooth texture you can really dig in to. Alright, joking answer aside, let me try my hand at God themed adventurers real quick: Our editors will review what you’ve submitted and determine whether to revise the article. When Cronos castrated his father Uranus and threw his testicles into the sea, the waters frothed and birthed the goddess Aphrodite. Although primarily known as the goddess of sexual love, fertility and beauty, Aphrodite – who was married to Ares – was also worshipped as a deity of the sea. As befits her origin story, her name comes from the Greek word aphros, meaning foam.

https://sharpeyesfvc.com/?p=52662

With Cascading Reels that sees the multiplier increase with each win, there is a Hand of God feature where each of the Greek gods unleashes their power to transform a set of symbols into another, add wilds or destroy 2 symbol sets. When you land wins with the gods, you fill up the meter next the reels which, when full, triggers the Wrath of Olympus feature. This awards free spins with each Hand of God extra playing out one after the other. To this bouquet of features, you will add the possibilities for winning one of 4 progressive jackpots. The bundle of attractive features will be expanded even more with that, in wwwfreeslots play. The Gates of Olympus slot machine features a 6×5 layout. This allows for plenty of action on the grid, but the big thing here is the fact that there aren’t typical paylines. Instead, this slot features the scatter pays. This means that you have to land matching symbols (in this case 8) anywhere on the grid, rather than in a line. This means that the ways to win are pretty much unlimited.

https://shorturl.fm/c2Chn

sportwetten tipps bild

my web blog wettbüRo Aachen

Thanks for your personal marvelous posting! I really enjoyed reading it,

you may be a great author.I will ensure that

I bookmark your blog and will come back later on. I want to encourage continue your great job, have a nice

holiday weekend!

my web-site – casino 21 blackjack (Cristine)

**sleep lean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

Die Wunderino gratis Freispiele müssen in der Regel innerhalb von 24 Stunden genutzt werden. 12. Kunden müssen das Rollover innerhalb 21 Tagen. Meteoritenschlag – Wird zufällig nach einem Abwurf oder einer Symbolauffüllung ausgelöst. Diese Funktion ersetzt eine Anzahl zufällig ausgewählter Auszahlungssymbole auf dem Raster durch Spezial-Symbole. © 2025 FreespinZA Casino. Alle Rechte vorbehalten. Der größte Betrug den ich je erlebt habe und ich bin kriminell. 200€ eingezahlt und nie irgendwas gewonnen. Heute locker 6 mal eingezahlt hier und einfach null, keine freispiele und keine Gewinne!!!!!!!!! Hab hier noch nie gewonnen, nicjt mal 5-6€.Wer hier einzahlt ist selber schuld. Ich werde das meinem Anwalt geben für die sammelklage und mein Geld zurück holen!!!!! Eine kompension wird vulkan vegas mir nicht anbieten für diese abzocke deswegen rechtlich рџ„ ihr werdet mir jeden cent zurück zahlen

https://www.starlineexpress.in/cygnus-2-von-elk-studios-ein-umfassender-review-fur-deutsche-spieler/

Gegründet im Jahr 2024, ist das Trino Casino ein junges und aufstrebendes Online-Casino. In dieser Bewertung erfahren Sie mehr über die vielfältigen Spielangebote, attraktiven Bonusprogramme und die Sicherheit, die das Casino bietet. Außerdem beleuchten wir den Kundensupport, die mobilen Nutzungsmöglichkeiten und geben Ihnen einen umfassenden Überblick über die Stärken und Schwächen dieses Casinos. Entdecken Sie, warum Trino Casino bei vielen Spielern beliebt ist und ob es auch Ihren Erwartungen entspricht. Die mit Spannung erwartete Gaming in Germany Konferenz 2023 steht Nach Ihrer Ersteinzahlung bekommen Sie sofort 20 Free Spins. Die verbleibenden Freispiele werden in den nächsten 4 Tagen mit 20 Freispielen pro Tag gutgeschrieben. Die mit dem Bonus erzielten Gewinne können wie üblich nicht sofort ausgezahlt werden. Für Bonusgeld Gewinne aus Freispielen gilt eine 40-fache Umsatzbedingung. Nach unserer Erfahrung ist das kein schlechter Wert. Umsatzbedingungen über 50x gelten bereits als schwer zu erreichen und nicht sehr günstig.

beste sportwetten vorhersagen

My webpage … erklärung handicap wette (Danuta)

wetten online Schweiz Wettanbieter

gratiswette ohne einzahlung merkur sportwetten (Ardis)

mit sportwetten bonus geld verdienen

Also visit my page … live wetten erklärung

**memory lift**

memory lift is an innovative dietary formula designed to naturally nurture brain wellness and sharpen cognitive performance.

sportwetten vergleich paypal

My blog … Pferderennen Wetten Gewinn

https://shorturl.fm/bSwhq

https://shorturl.fm/ToQof

The new version of the slot takes players to the world of the Wild West, while Pirots 2 transported them on a journey to dinosaurs. In the Pirots 3 slot, you’ll discover thrilling gameplay that mixes vibrant visuals with engaging mechanics. By trying out the Pirots 3 demo, you can learn how the features work, from the Wilds to the special symbols, and how they trigger exciting bonus rounds. The Pirots 3 demo is also a great opportunity to try out different strategies and see how the slot performs before you decide to play with real money. At a cost of 99 times the base bet, the player is guaranteed to activate xHole™. The defining feature of the Pirots series is this innovative CollectR payout system, where parrot characters dynamically move around the grid, collecting matching colored gems, creating an engaging and unique gameplay experience compared to traditional slot games.

https://jobs.njota.org/profiles/7269463-jenny-taylor

Pirots 3 introduces the innovative CollectR mechanic, where wins are achieved by parrots collecting adjacent gems of matching colors. This system replaces traditional paylines, offering a fresh and engaging gameplay experience. Boom Pirates Fight for Gold is adrenaline-pumping, with extra spins and multipliers for those not afraid of grabbing the helm. This video slot makes each turn a potential gold mine with up to 20,000x from the Grand Jackpot. So, strap your eye patch and get into the Yo-Ho-Ho treasure hunt for a fun-filled escapade. Michael Shimmer is a trusted demo reviewer with 5+ years of experience testing real and demo versions of high-volatility slots. His testing methodology helps players understand bonus probabilities before risking real cash. The game Money Mines was created by Buck Stakes Entertainment. The game has powerful Epic Strike elements, including jackpots, and recounts a story with mythical themes, with dwarves as its major heroes. All four of the low symbols include these characters, while the high symbols feature single, double, and triple sevens. The slot machine Money Mines features 5 reels by 3 reels and 20 paylines. Roughly $250,000 can be won by betting just $1 and winning 2,000 x that amount.

live sportwetten strategie

Here is my homepage :: Bonus buchmacher

neue wettanbieter ohne oasis

Here is my web page … sportwetten öSterreich

Free spins without deposit on the inverse, as there are often new casino 200% bonus offers released by online casinos. How To Play Blackjack Live? Goosicorn brings a dose of quirky magic to the world of online slots and casino games. Play fully exclusive slots and fun casino games at MrQ. If you dig Mega Joker’s low-tech style and bonus gamble, check out the classic triple reel vibes in Epic Joker, a Relax Gaming slot with high RTP and Supermode mechanics. Integrating Spearhead Studios content into our burgeoning portfolio is another step in supporting our partners in delivering the best possible casino experience to their players, Evoreels Casino is also running several other promotions. The only difference is that live dealer games are weighted differently, so it depends on your preference. Big pound casino no deposit bonus codes 2025 United Kingdom want to play Casinokakadu online games on the go, this is a decent offer that isnt particularly competitive as it is hampered by high requirements and a short validity period. To check the fees Wildz charges for deposits, the wild also plays a part in one of 8 bonus features.

https://2tctech.vn/big-bass-bonanza-demo-uk-slot-review/

Mid Autumn Voucher Despite a cheery classic theme and high volatility, Fruit Shop Megaway’s RTP of 93.01% is simply too low to merit a recommendation. Up to 5 free spins can be activated by matching numbered fruits along a payline. An additional up to 5 free spins can be awarded for matching up numbered fruit symbols during the free spins mode. 2104guest All the Non-Gamstop poker sites above provide exceptional bonuses for both newcomers and existing players, it is a perfect slot machine for beginners. The former US leader reignited the speculation during a casual game of golf captured on camera, information and forums on online casino operators. Enjoy a wide variety of duty-free shopping onboard. The world of fruit slots is packed with juicy titles, and we’ve hand-picked some of the best from leading providers. These games combine the charm of classic fruit machines with the excitement of modern features. Here are some of the most popular fruit slots you can spin right now:

wettstrategien test

Stop by my blog post: sportwetten strategie hohe quoten (Landon)

https://shorturl.fm/7tASf

pferderennen wetten schweiz

Visit my blog post :: Sportwetten Bester Bonus

https://shorturl.fm/U9rLC

wettbüro bremerhaven

Here is my web page … beste sportwetten online

https://shorturl.fm/A4U2D

RooBet Casino presenterer førsteklasses baccarat-spill fra ledende globale spillleverandører. Disse spillene har ofte forhøyede innsatsgrenser, noe som passer for storspillere. Utvalget omfatter varianter som mini-baccarat, baccarat Gold, baccarat Punto Banco, 3D-baccarat og baccarat uten provisjon. Til tross for at baccarat er et sjansespill, holder det et rolig tempo, er lett å forstå og fungerer som et ideelt valg for nybegynnere, siden det ikke krever spesialiserte ferdigheter eller strategier. RooBet Casino presenterer førsteklasses baccarat-spill fra ledende globale spillleverandører. Disse spillene har ofte forhøyede innsatsgrenser, noe som passer for storspillere. Utvalget omfatter varianter som mini-baccarat, baccarat Gold, baccarat Punto Banco, 3D-baccarat og baccarat uten provisjon. Til tross for at baccarat er et sjansespill, holder det et rolig tempo, er lett å forstå og fungerer som et ideelt valg for nybegynnere, siden det ikke krever spesialiserte ferdigheter eller strategier.

https://miottodistribuidora.com.br/mission-uncrossable-casino-de-beste-stedene-a-spille/

Stake har lisens fra Antillephone N.V som er autorisert og regulert av myndighetene på Curacao. De er også en verifisert operatør hos Crypto Gambling Foundation, som bidrar til å opprettholde den høyeste standarden for trygg gambling når det kommer til krypto. Alt dette gir Stake og alle spillere hos Stake en trygg og sikker fornøyelse. Blackgulf is Worlds’s one of the largest classifieds site Faugli, Per Einar. Rjukan Notodden : vannkraft og verdensarv : norsk vassdragshistorie. 2015 We’re proud to provide a platform that connects world, – Selvsagt kunne jeg ikke ta dem med meg hjem. De er barn av IS-krigere. Målet vårt er å gi deg en reise med natur, dyreliv og seilingens utfordringer – med utgangspunkt i Bodø og den vakre skjærgården vi har her. Området vi beveger oss i strekker seg fra Helgeland til Lofoten. Hva med et seilintrokurs på 1 dag? Båtene våre ligger ved moloen i Bodø, og vi kan garantere en flott opplevelse. Vi har to båter klare til nye opplevelser:

https://playgama.com/game/idle-pop-merge

https://shorturl.fm/ZGmx4

https://shorturl.fm/cwJA2

https://steamify.io/crosshair-cs2/fransson

https://shorturl.fm/GKP8h

https://shorturl.fm/rTN4o

https://shorturl.fm/LIglg

https://shorturl.fm/4pE2Y

nw64c3

https://shorturl.fm/8Xh9u

https://shorturl.fm/iAxJY

https://shorturl.fm/6iAXe

NOS CONDITIONS GENERALES DE VENTE | BON DE COMMANDE Whether you’re a fan of the original Gates of Olympus or new to the world of Zeus, this app provides an authentic and thrilling slot experience. The intuitive interface makes it easy to spin the reels and chase those godly wins. Livraison offerte dès 150€ d’achat (en France métropolitaine par Colissimo) Gates of Olympus est une machine à sous sur le thème des dieux et des déesses grecs. Les couleurs bleu et rose nous transportent tout de suite dans l’univers du jeu. Les symboles disposent d’un design élégant et ont également été étudiés pour rappeler le thème des dieux grecs. On retrouve des coupes, des bijoux, des sabliers, et Zeus qui fait office de symbole Scatter. Concernant la musique et les effets sonores, ils complètent parfaitement les graphismes pour nous faire voyager au cœur de l’Olympe et nous garder bien éveillé.

https://aestheticsolutionsny.com/malina-casino-une-reference-incontournable-pour-les-joueurs-francais/

Volatilité big bass splash: La fonction de pari permet de placer le montant total du gain ou la moitié de celui-ci sur la mise de pari, alors recherchez des gains plus importants sur les quintes plutôt que sur les flushs. Si vous êtes désireux de trouver plus de machines à sous à jouer, mais vous ne pouvez gagner qu’une seule fois sur chaque ligne de victoire. Si vous êtes prêt à commencer à jouer, vous pouvez tenter votre chance avec le comptage des cartes. COPYRIGHT © 2015 – 2025. Tous droits réservés à Pragmatic Play, un investissement de Veridian (Gibraltar) Limited. Tout le contenu présent sur ce site ou intégré par référence est protégé par les lois internationales sur le droit d’auteur. Yossi Barzely, Chief Business Development Officer chez Pragmatic Play, a déclaré : « S’appuyer sur l’une de nos franchises vedettes tout en offrant de nouvelles fonctionnalités et de nouvelles mécaniques comme dans Big Bass Splash™ est une occasion passionnante de dépasser les attentes des joueurs et de revitaliser une série favorite des fans. »

https://shorturl.fm/X4Xlg

https://shorturl.fm/mJqip

So while I think that Feelmatic is actually a pretty solid and interesting video editing app with great potential definitely worth checking out, VN is more powerful in terms of features and the export process is less cumbersome. You should definitely check out both apps if you are into mobile video editing unless you are worried about their business model. If you don’t mind a watermark on the exported video or paying for a subscription, KineMaster is still the best and most compatible option available for both major mobile platforms. Let me know what you think in the comments or on Twitter @smartfilming. Vn app also provides you with speed templates to apply to your video. Vn also comes with the speed curve feature, similar to the most advanced video editor, Adobe Premier Pro’s speed remapping. You can also add some transitions and cool effects and make your content viral. Vn also allows users to import Lut filters to give their videos a professional look.

https://www.hosteriatello.cl/2025/10/24/african-buffalo-slot-vs-buffalo-king-megaways-which-to-play/

Attain 4 or more scatter symbols on any screen section, and you’ll receive 15 extra game rounds that will let you play Gates of Betano Olympus for free. Multiplier icons will randomly show up, and whenever they land in a winning combination, the total multiplier will apply to the successful outcome. In addition, 3 or more scatter symbols during this bonus feature will award 5 extra free spins. With 243 paylines, special prizes, a prize wheel, and free spins rounds, Greek Gods is a fantastic slot, and its golden godly theme is great. If you love the look of Gates of Olympus, and are seeking something equally steeped in Greek mythology, Greek Gods is a perfect choice. It has Zeus as one of its main symbols, and the backdrop is a Greek building with columns that somewhat resembles the Parthenon.

https://shorturl.fm/7MM4H

https://shorturl.fm/Gew4D

https://shorturl.fm/TqzWG

https://shorturl.fm/ZVgQg

https://shorturl.fm/2Co6R

buôn bán vũ khi

https://shorturl.fm/035Nh

aliann.in.net bạo lực

(10 euros gratis apuestas|10 mejores casas de apuestas|10 trucos para ganar apuestas|15 euros

gratis marca apuestas|1×2 apuestas|1×2 apuestas deportivas|1×2

apuestas que significa|1×2 en apuestas|1×2 en apuestas que significa|1×2 que significa en apuestas|5 euros gratis apuestas|9 apuestas

que siempre ganaras|a partir de cuanto se declara apuestas|actividades de juegos de azar y apuestas|ad apuestas

deportivas|aleksandre topuria ufc apuestas|algoritmo para ganar apuestas deportivas|america apuestas|análisis nba apuestas|aplicacion android apuestas deportivas|aplicacion apuestas deportivas|aplicacion apuestas deportivas android|aplicación de apuestas online|aplicacion para hacer apuestas|aplicacion para hacer apuestas de futbol|aplicación para hacer

apuestas de fútbol|aplicaciones apuestas deportivas android|aplicaciones apuestas deportivas gratis|aplicaciones de apuestas android|aplicaciones de apuestas de fútbol|aplicaciones de apuestas deportivas|aplicaciones de apuestas deportivas peru|aplicaciones de apuestas deportivas perú|aplicaciones de apuestas en colombia|aplicaciones de apuestas gratis|aplicaciones de apuestas online|aplicaciones de apuestas seguras|aplicaciones

de apuestas sin dinero|aplicaciones para hacer apuestas|apostar seguro apuestas

deportivas|app android apuestas deportivas|app apuestas|app apuestas android|app apuestas de futbol|app apuestas deportivas|app apuestas deportivas android|app apuestas deportivas argentina|app apuestas deportivas

colombia|app apuestas deportivas ecuador|app apuestas deportivas españa|app apuestas deportivas gratis|app

apuestas entre amigos|app apuestas futbol|app

apuestas gratis|app apuestas sin dinero|app casa de apuestas|app casas de apuestas|app control apuestas|app

de apuestas|app de apuestas android|app de apuestas casino|app de apuestas colombia|app de apuestas con bono

de bienvenida|app de apuestas de futbol|app de apuestas deportivas|app de apuestas

deportivas android|app de apuestas deportivas argentina|app de apuestas deportivas colombia|app de apuestas deportivas en españa|app de apuestas deportivas peru|app de

apuestas deportivas perú|app de apuestas deportivas sin dinero|app de apuestas ecuador|app de apuestas en colombia|app de apuestas en españa|app de apuestas en venezuela|app de apuestas futbol|app de

apuestas gratis|app de apuestas online|app de apuestas para

android|app de apuestas para ganar dinero|app de apuestas peru|app de apuestas reales|app de casas de apuestas|app marca apuestas android|app moviles de apuestas|app para apuestas|app para apuestas

de futbol|app para apuestas deportivas|app para apuestas deportivas en español|app para ganar

apuestas deportivas|app para hacer apuestas|app para hacer apuestas deportivas|app para

hacer apuestas entre amigos|app para llevar control de apuestas|app

pronosticos apuestas deportivas|app versus apuestas|apps apuestas mundial|apps

de apuestas|apps de apuestas con bono de bienvenida|apps de apuestas de

futbol|apps de apuestas deportivas peru|apps de apuestas mexico|apps para apuestas|aprender a hacer apuestas deportivas|aprender

hacer apuestas deportivas|apuesta del dia apuestas

deportivas|apuestas 10 euros gratis|apuestas 100 seguras|apuestas 1×2|apuestas 1X2|apuestas 2 division|apuestas 3 division|apuestas a caballos|apuestas a carreras de caballos|apuestas a colombia|apuestas a corners|apuestas

a ganar|apuestas a jugadores nba|apuestas a la baja|apuestas a la

nfl|apuestas al barcelona|apuestas al dia|apuestas al empate|apuestas al

mundial|apuestas al tenis wta|apuestas alaves barcelona|apuestas alcaraz hoy|apuestas

alemania españa|apuestas alonso campeon del mundo|apuestas altas y bajas|apuestas altas y bajas nfl|apuestas ambos equipos marcan|apuestas america|apuestas android|apuestas anillo nba|apuestas antes del mundial|apuestas anticipadas|apuestas anticipadas nba|apuestas apps|apuestas arabia argentina|apuestas argentina|apuestas argentina campeon del mundo|apuestas argentina canada|apuestas argentina colombia|apuestas argentina croacia|apuestas argentina españa|apuestas argentina francia|apuestas argentina francia cuanto paga|apuestas argentina francia mundial|apuestas argentina

gana el mundial|apuestas argentina gana mundial|apuestas argentina holanda|apuestas argentina mexico|apuestas

argentina méxico|apuestas argentina mundial|apuestas argentina online|apuestas argentina paises bajos|apuestas argentina polonia|apuestas argentina uruguay|apuestas argentina vs australia|apuestas argentina vs colombia|apuestas argentina vs francia|apuestas argentina vs peru|apuestas argentinas|apuestas arsenal real madrid|apuestas ascenso a primera division|apuestas ascenso a segunda|apuestas asiaticas|apuestas asiatico|apuestas athletic|apuestas athletic atletico|apuestas athletic barça|apuestas athletic barcelona|apuestas athletic betis|apuestas athletic manchester|apuestas athletic manchester united|apuestas athletic osasuna|apuestas athletic real|apuestas athletic real madrid|apuestas athletic real sociedad|apuestas athletic real sociedad final|apuestas

athletic roma|apuestas athletic sevilla|apuestas athletic valencia|apuestas atletico|apuestas atletico barcelona|apuestas atletico barsa|apuestas atletico campeon champions|apuestas atletico campeon de liga|apuestas atlético copenhague|apuestas atletico de madrid|apuestas

atlético de madrid|apuestas atletico de madrid barcelona|apuestas atletico de madrid gana la liga|apuestas atletico de madrid real madrid|apuestas

atlético de madrid real madrid|apuestas atletico de madrid vs barcelona|apuestas

atletico madrid|apuestas atletico madrid real madrid|apuestas atletico madrid vs barcelona|apuestas atletico real madrid|apuestas atletico real madrid champions|apuestas atletismo|apuestas bajas|apuestas baloncesto|apuestas baloncesto

acb|apuestas baloncesto handicap|apuestas baloncesto hoy|apuestas

baloncesto juegos olimpicos|apuestas baloncesto nba|apuestas baloncesto pronostico|apuestas baloncesto pronósticos|apuestas baloncesto prorroga|apuestas barca|apuestas barca athletic|apuestas barca atletico|apuestas barca bayern|apuestas barca bayern munich|apuestas barca

girona|apuestas barca hoy|apuestas barça hoy|apuestas barca inter|apuestas barca juventus|apuestas barca

madrid|apuestas barça madrid|apuestas barca real madrid|apuestas barca vs juve|apuestas barca vs madrid|apuestas barca vs psg|apuestas barcelona|apuestas barcelona alaves|apuestas barcelona athletic|apuestas barcelona atletico|apuestas barcelona atletico de madrid|apuestas barcelona atlético de

madrid|apuestas barcelona atletico madrid|apuestas

barcelona bayern|apuestas barcelona betis|apuestas barcelona campeon de liga|apuestas

barcelona celta|apuestas barcelona espanyol|apuestas

barcelona gana la champions|apuestas barcelona girona|apuestas barcelona granada|apuestas barcelona

hoy|apuestas barcelona inter|apuestas barcelona madrid|apuestas barcelona osasuna|apuestas barcelona psg|apuestas barcelona real madrid|apuestas barcelona real sociedad|apuestas barcelona sevilla|apuestas barcelona valencia|apuestas barcelona villarreal|apuestas barcelona vs atletico madrid|apuestas barcelona vs madrid|apuestas barcelona vs real madrid|apuestas barsa madrid|apuestas basket hoy|apuestas

bayern barcelona|apuestas bayern vs barcelona|apuestas beisbol|apuestas béisbol|apuestas beisbol mlb|apuestas beisbol pronosticos|apuestas beisbol venezolano|apuestas betis|apuestas betis – chelsea|apuestas betis barcelona|apuestas betis chelsea|apuestas betis fiorentina|apuestas

betis girona|apuestas betis madrid|apuestas betis mallorca|apuestas betis

real madrid|apuestas betis real sociedad|apuestas betis sevilla|apuestas betis valencia|apuestas betis valladolid|apuestas betis vs

valencia|apuestas betplay hoy colombia|apuestas betsson peru|apuestas bienvenida|apuestas billar online|apuestas bolivia vs

colombia|apuestas bono|apuestas bono bienvenida|apuestas bono de bienvenida|apuestas bono de bienvenida sin deposito|apuestas bono gratis|apuestas bono sin deposito|apuestas

bonos sin deposito|apuestas borussia real madrid|apuestas boxeo|apuestas boxeo de campeonato|apuestas

boxeo españa|apuestas boxeo español|apuestas boxeo femenino olimpiadas|apuestas boxeo hoy|apuestas boxeo online|apuestas brasil colombia|apuestas brasil peru|apuestas brasil

uruguay|apuestas brasil vs colombia|apuestas brasil vs peru|apuestas caballos|apuestas caballos colocado|apuestas caballos españa|apuestas caballos hipodromo|apuestas caballos hoy|apuestas caballos madrid|apuestas caballos online|apuestas caballos

sanlucar de barrameda|apuestas caballos zarzuela|apuestas calculador|apuestas campeon|apuestas campeon champions|apuestas campeón champions|apuestas

campeon champions 2025|apuestas campeon champions league|apuestas

campeon conference league|apuestas campeon copa america|apuestas campeon copa del rey|apuestas

campeon de champions|apuestas campeon de la champions|apuestas campeon de liga|apuestas campeon del mundo|apuestas campeon eurocopa|apuestas campeón eurocopa|apuestas campeon europa league|apuestas campeon f1|apuestas campeon f1 2025|apuestas

campeon formula 1|apuestas campeon libertadores|apuestas campeon liga|apuestas campeon liga bbva|apuestas campeon liga española|apuestas campeon liga santander|apuestas campeon motogp 2025|apuestas campeon mundial|apuestas campeón mundial|apuestas

campeon mundial baloncesto|apuestas campeon nba|apuestas campeón nba|apuestas

campeon premier|apuestas campeon premier league|apuestas campeon roland

garros|apuestas campeonato f1|apuestas campeonatos de futbol|apuestas carrera de caballos|apuestas carrera de caballos hoy|apuestas carrera de

caballos nocturnas|apuestas carrera de galgos fin de semana|apuestas

carrera de galgos hoy|apuestas carrera de galgos nocturnas|apuestas

carreras caballos|apuestas carreras caballos sanlucar|apuestas

carreras de caballos|apuestas carreras de caballos en directo|apuestas carreras de caballos en vivo|apuestas carreras de caballos españa|apuestas carreras de caballos hoy|apuestas carreras de

caballos nacionales|apuestas carreras de caballos nocturnas|apuestas carreras

de caballos online|apuestas carreras de caballos sanlucar|apuestas carreras de caballos sanlúcar|apuestas

carreras de galgos|apuestas carreras de galgos en vivo|apuestas carreras de galgos

nocturnas|apuestas carreras de galgos pre partido|apuestas casino|apuestas casino barcelona|apuestas

casino futbol|apuestas casino gran madrid|apuestas casino gratis|apuestas casino madrid|apuestas casino online|apuestas casino online argentina|apuestas casinos|apuestas casinos online|apuestas celta|apuestas celta

barcelona|apuestas celta betis|apuestas celta eibar|apuestas

celta espanyol|apuestas celta granada|apuestas celta

madrid|apuestas celta manchester|apuestas celta real madrid|apuestas champion league|apuestas champions foro|apuestas champions hoy|apuestas champions league|apuestas champions league –

pronósticos|apuestas champions league 2025|apuestas

champions league hoy|apuestas champions league pronosticos|apuestas champions league pronósticos|apuestas champions pronosticos|apuestas chelsea barcelona|apuestas chelsea betis|apuestas chile|apuestas chile peru|apuestas chile venezuela|apuestas chile vs

colombia|apuestas chile vs uruguay|apuestas ciclismo|apuestas ciclismo en vivo|apuestas ciclismo femenino|apuestas ciclismo tour francia|apuestas ciclismo vuelta|apuestas ciclismo vuelta a españa|apuestas ciclismo

vuelta españa|apuestas city madrid|apuestas city real madrid|apuestas clasico|apuestas clasico español|apuestas clasico

real madrid barcelona|apuestas clasificacion mundial|apuestas colombia|apuestas colombia

argentina|apuestas colombia brasil|apuestas colombia paraguay|apuestas colombia uruguay|apuestas colombia vs argentina|apuestas colombia vs brasil|apuestas combinadas|apuestas combinadas como funcionan|apuestas combinadas de futbol|apuestas combinadas de fútbol|apuestas

combinadas foro|apuestas combinadas futbol|apuestas combinadas hoy|apuestas combinadas mismo partido|apuestas combinadas

mundial|apuestas combinadas nba|apuestas combinadas para esta semana|apuestas combinadas para hoy|apuestas combinadas

para mañana|apuestas combinadas pronosticos|apuestas combinadas recomendadas|apuestas combinadas seguras|apuestas combinadas seguras para hoy|apuestas combinadas

seguras para mañana|apuestas como ganar|apuestas comparador|apuestas con bono de bienvenida|apuestas con dinero

ficticio|apuestas con dinero real|apuestas con dinero virtual|apuestas con handicap|apuestas con handicap asiatico|apuestas con handicap baloncesto|apuestas con mas probabilidades de ganar|apuestas con paypal|apuestas con tarjeta de credito|apuestas con tarjeta de debito|apuestas consejos|apuestas copa|apuestas

copa africa|apuestas copa america|apuestas copa américa|apuestas copa argentina|apuestas copa brasil|apuestas copa

davis|apuestas copa de europa|apuestas copa del mundo|apuestas copa del rey|apuestas copa del rey

baloncesto|apuestas copa del rey final|apuestas copa del rey futbol|apuestas copa del rey ganador|apuestas copa

del rey hoy|apuestas copa del rey pronosticos|apuestas copa del rey pronósticos|apuestas copa europa|apuestas copa

italia|apuestas copa libertadores|apuestas copa mundial de hockey|apuestas copa rey|apuestas copa sudamericana|apuestas corners|apuestas corners hoy|apuestas croacia argentina|apuestas cuartos eurocopa|apuestas cuotas|apuestas cuotas altas|apuestas cuotas bajas|apuestas de 1 euro|apuestas de baloncesto|apuestas de baloncesto hoy|apuestas de baloncesto

nba|apuestas de baloncesto para hoy|apuestas

de beisbol|apuestas de beisbol para hoy|apuestas de blackjack en linea|apuestas de boxeo|apuestas de boxeo canelo|apuestas de

boxeo en las vegas|apuestas de boxeo hoy|apuestas de boxeo online|apuestas de caballo|apuestas de caballos|apuestas de caballos como funciona|apuestas de caballos como se juega|apuestas de caballos en colombia|apuestas de caballos en españa|apuestas

de caballos en linea|apuestas de caballos españa|apuestas de caballos ganador y colocado|apuestas de caballos internacionales|apuestas de caballos juegos|apuestas de

caballos online|apuestas de caballos online en venezuela|apuestas de caballos por internet|apuestas de

caballos pronosticos|apuestas de caballos pronósticos|apuestas de carrera de caballos|apuestas de carreras de caballos|apuestas de carreras de

caballos online|apuestas de casino|apuestas de casino online|apuestas de casino por internet|apuestas de

champions league|apuestas de ciclismo|apuestas de colombia|apuestas

de copa america|apuestas de corners|apuestas de deportes en linea|apuestas de deportes online|apuestas

de dinero|apuestas de esports|apuestas de

eurocopa|apuestas de europa league|apuestas de

f1|apuestas de formula 1|apuestas de futbol|apuestas de fútbol|apuestas de futbol app|apuestas de futbol argentina|apuestas de futbol colombia|apuestas de futbol en colombia|apuestas de futbol en directo|apuestas de

futbol en linea|apuestas de futbol en vivo|apuestas de

futbol español|apuestas de futbol gratis|apuestas de futbol

hoy|apuestas de futbol mundial|apuestas de futbol online|apuestas de

fútbol online|apuestas de futbol para hoy|apuestas de

fútbol para hoy|apuestas de futbol para hoy seguras|apuestas de futbol para mañana|apuestas de futbol peru|apuestas de futbol pronosticos|apuestas de fútbol pronósticos|apuestas de futbol seguras|apuestas de futbol seguras para hoy|apuestas de futbol sin dinero|apuestas de galgos|apuestas de galgos como

ganar|apuestas de galgos en directo|apuestas de galgos online|apuestas de galgos trucos|apuestas de golf|apuestas de hockey|apuestas de hockey sobre hielo|apuestas de hoy|apuestas de

hoy seguras|apuestas de juego|apuestas de juegos|apuestas

de juegos deportivos|apuestas de juegos online|apuestas de la champions league|apuestas de la copa américa|apuestas de la eurocopa|apuestas de la europa league|apuestas de

la liga|apuestas de la liga bbva|apuestas de la liga española|apuestas de la nba|apuestas de